north carolina real estate taxes

March 31st - This is the last day to pay taxes before the delinquency is advertised in The Sylva Herald. In North Carolina transfer taxes depend on the county.

How To Know When To Appeal Your Property Tax Assessment Bankrate

As part of NCDMVs Tag Tax Together program the.

. Property Tax The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the. Department of Revenue does not send property tax bills or collect property. CAPITAL GAINS - Top rate of 58.

Taxes must be paid on or before. Taxes are due and payable September 1st. Behind the Historic Post Office.

Be the First to Know when North Carolina Tax Developments Impact Your Business or Clients. Ad Bloomberg Tax Expert Analysis Your Comprehensive North Carolina Tax Information Resource. Join The Millions Who File Smarter.

Find Out the Historical Market Value of Any Property. Counties in North Carolina collect an average of 078 of a propertys. Real estate and personal property listed for taxation during January are billed in July and may be paid on or before August 31 to receive a 12 discount.

Enter Any County Address. Located on Crowell St. The property tax in North Carolina is a locally assessed tax collected by the counties.

It was founded in 2000 and has since become a part of the. ANNUAL REAL ESTATE PERSONAL PROPERTY AND POLICE SERVICE DISTRICT TAX. Find Out the Historical Market Value of Any Property.

An interest charge of 2 is assessed on 2021 delinquent property tax. North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. If a home sold for 200000 the taxes would be 500.

The average effective property tax rate in North Carolina is 077 which. April - Property tax. Ad Get Record Information From 2021 About Any County Property.

CuraDebt is a company that provides debt relief from Hollywood Florida. Ad Taxes Can Be Complex. North Carolina Property Tax By County.

Ad Get Record Information From 2021 About Any County Property. Ad Receive Competitive Prices From Property Tax Experts In Minutes. Taxes are due and payable September 1st.

North Carolina Tax Assessors. Let A Tax Expert Take Taxes Off Your Plate. About the Company North Carolina Property Tax Relief.

Ad Bloomberg Tax Expert Analysis Your Comprehensive North Carolina Tax Information Resource. Division of Motor Vehicles. The tax lien or assessment date each year is January 1st.

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. 2021 taxes are payable without interest through January 5 2022. In most places the tax is 1 for every 500 in value of the home.

CAROLINA TAX COMPARISON AT A GLANCE. INCOME TAX - Flat rate of 575. Pay at the Tax Collectors office on the first floor of the Union.

The average effective property tax rate in North Carolina is 086 well under the national average of 108. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. INTANGIBLES TAX - None.

For example a 600 transfer tax would be imposed. Be the First to Know when North Carolina Tax Developments Impact Your Business or Clients. How does a delinquent tax sale work.

January 6th - Property taxes become delinquent. North Carolinas property tax rates are nonetheless relatively low in comparison to what exists in other states. Enter Any County Address.

Let TurboTax Find Every Realtor Deduction To Maximize Your Refund.

The Ultimate Guide To North Carolina Property Taxes

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Wake County Nc Property Tax Calculator Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Tax Administration Duplin County Nc Duplin County Nc

How To Calculate Closing Costs On A Home Real Estate

Pin On Jacksonville Nc Real Estate

North Carolina Real Estate Transfer Taxes An In Depth Guide

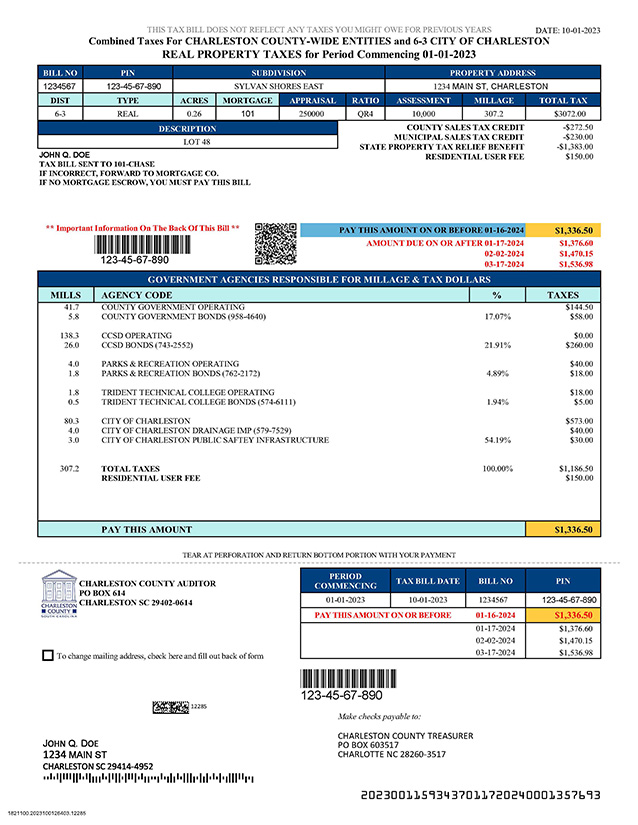

Sample Real Property Tax Bill Charleston County Government

Real Estate Property Tax Data Charleston County Economic Development

Property Tax Relief For Homeowners Disability Rights North Carolina

2022 What To Expect In North Carolina Real Estate

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas